What States Is Federal Service Pensions Not Retirement Not Taxed

iStock / Getty Images

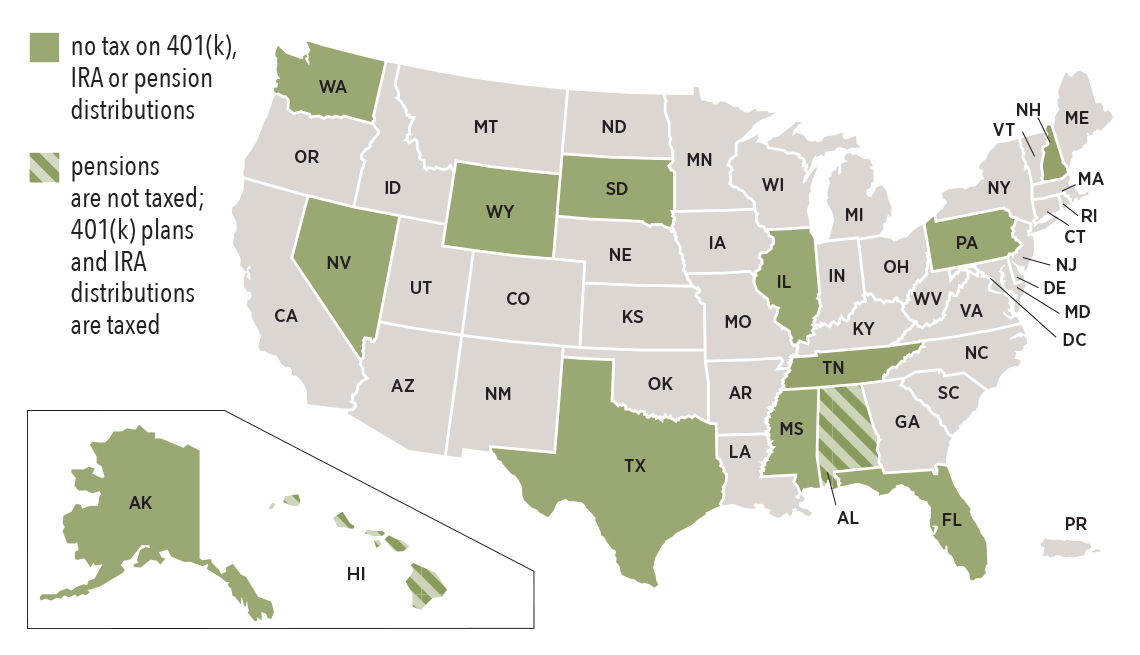

En español | One of the biggest items on your retirement upkeep is taxes. If you lot're thinking of moving somewhere else, consider i of the 12 states that don't tax distributions from pensions or defined contribution plans such equally 401(k) plans.

A lack of tax

Nine of those states that don't tax retirement plan income simply considering distributions from retirement plans are considered income, and these nine states have no state income taxes at all: Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington and Wyoming. The remaining 3 — Illinois, Mississippi and Pennsylvania — don't tax distributions from 401(k) plans, IRAs or pensions. Alabama and Hawaii don't taxation pensions, but do tax distributions from 401(g) plans and IRAs.

Land Taxes and Retirement Distributions

AARP

Taxing retirement program distributions isn't an all-or-nothing proposition. For case, 34 states don't tax armed forces retirement income. Nine of those, are us listed above that don't have income taxes. The others: Arizona, Alabama, Arkansas, Connecticut, Hawaii, Illinois, Indiana, Iowa, Kansas, Louisiana, Maine, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Nebraska, New Bailiwick of jersey, New York, North Carolina, North Dakota, Ohio, Pennsylvania, Utah, West Virginia and Wisconsin. California, Vermont, Virginia and Washington, D.C. fully tax armed forces retirement pay. All other states have partial allowances for military pay. And Virginia only allows Congressional Medal of Honor recipients to exclude their military retirement income.

Note: You may not take paid tax on your retirement income, simply that doesn't mean that your state doesn't tax retirement income nether sure weather condition: 27 states revenue enhancement some, but not all, retirement or alimony income. Typically, these states limit the amount of taxation by income levels.

Taxes aren't everything

Some states with low or no income taxes have college property or sales taxes. For case, while Illinois does non tax retirement income, it has one of the highest sales and property taxes in the U.South. Other low-tax states may have fewer programs that yous might find helpful, such as senior centers and public transportation.

Ultimately, where you lot live in retirement depends on what you tin can afford — and what makes yous happy. If you lot have a love child or grandchild in a high-tax state, you may figure the extra taxes are worth being nearby.

What States Is Federal Service Pensions Not Retirement Not Taxed,

Source: https://www.aarp.org/money/taxes/info-2020/states-that-dont-tax-retirement-distributions.html

Posted by: sanchezinviand92.blogspot.com

0 Response to "What States Is Federal Service Pensions Not Retirement Not Taxed"

Post a Comment